News

31 Jan 2018

ACETA: The Survey that had to be Done

Subscribe to CX E-News

ACETA: The Survey that had to be Done

And the consequence will surprise, excite and deliver for those truly invested

Frank Hinton

President, Australian and Commercial Entertainment Technologies Association

In preparing this month’s editorial, I sensed that the impending narrative would deliver total surprise to most industry participants, who will instantly recognise the game-changing nature of a new ACETA initiative that will facilitate far reaching development and opportunity for members.

The subject matter not only details the findings of our comprehensive survey that reveals the current size and nature of entertainment technology creation in Australia, but offers a clear insight into its potential. Deciding on the presentation manner for this editorial was obvious, such informative and compelling material is best relayed as it is.

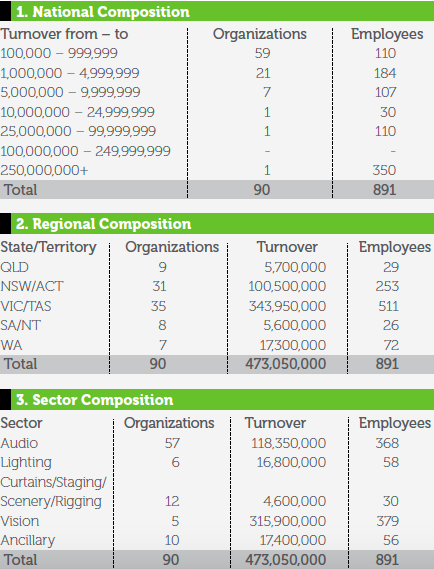

The survey set out to establish the number, financial output and employment statistics of Australian organisations engaged in creating and manufacturing entertainment technology, a challenging but necessary task to drive industry and nation building.

Inclusion in the survey required organisations to be at least 51% locally owned, subject to Australian law, employing at least one full time individual and engaged in the research and development of entertainment technology, produced or partially produced in Australia.

With regard to financial output, approximately 85% of the aggregate is on the public record or confirmed by reliable sources, the remaining 15% is speculation based on logic and credible information.

Establishing employment numbers followed similar parameters, taking into account only those employed in Australia and excluding sub-contractors. It is possible there are qualifying organisations that have escaped attention who can be included at a later date. Over or under estimating of the 15% proportion not on the public record or confirmed, will even out as a matter of course in the aggregation, therefore, we suggest the survey statistics are accurate to within plus or minus 2%.

The survey also shows there is no reliable formula in correlating employment numbers to financial output. Some organisations and sectors are labour intensive, others highly automated, a number manufacture off-shore and some sub-contract all or part of their production.

Following is the statistical data that defines the current composition of entertainment technology creation in Australia, we will conclude with a few revealing insights and summary.

The survey revealed that the three largest organisations had established a strong export presence and a growing international market share. However, with a few exceptions the majority of the 90-listed organisations had either a sporadic or no export program, relying instead on the small Australian market (around1.5% of the world total) to sustain their business. A hypothetical analysis will lend perspective to the possibilities; given the same circumstances and market penetration a company turning over $100,000 in Australia would be turning over $1,316,000 if based in the USA.

And a company turning over $999,999 in Australia would be turning over $13,160,000 if based in the USA. These figures are in AUD, based on market similarities and a USA population 13.16 times the size of Australia, with enhanced opportunity of export due to a significantly higher income base.

The majority of Australian companies in the survey, 59 in total (or 66%) currently turn over $100,000 to $999,999, therefore the key indicators in this survey are positive and present remarkable potential for financial output and employment growth, but we must export.

The manufacturing sector of our Western nation competitors, particularly the UK, Europe and the USA operate in well-established decentralised environments, benefiting from realistic manufacturing and warehousing cost structures, not so Australia. Our survey shows we are primarily centralised in the capital cities, in particular the two highest cost of all Melbourne and Sydney where real estate, services and employment costs are by far the highest in the nation.

As the market place is also rapidly decentralising, thanks to the internet, many of our manufacturers would be wise to investigate re-location to a much lower operational-cost region, to ensure we can successfully compete on a more level playing field. This important issue is being addressed by ACETA on behalf of the membership, and will be addressed in the form of a re-location program at the inaugural convention in May 2018, in collaboration with the Wangaratta City Council.

In summary, the survey confirmed, Australia’s entertainment technology creative / manufacturing sector finds itself well positioned to substantially elevate its international influence and become a significant source of entertainment technology supply in all its forms.

With only a few exceptions, the sector is conveniently compact, niche by nature, resilient, proven in the development of high performance technology, and with very little baggage, a highly desirable international supply partner. But most importantly it is now empowered with its own increasingly influential ‘peak body’.

With or without the participation of any particular organisation, ACETA is determined to prevail.

In partnering with resourcing agencies and the establishment of development programmes, the current financial output of 473 million could become a billion and 891 employed individuals could become 2,000 or more. Obviously only bona-fide ACETA members receive the benefits and qualify for inclusion in programs, therefore it may be in your best interests to join the vision and secure the future. Contact www.aceta.org. au or phone (03) 9254 1033.

All the best

Frank Hinton

President ACETA

ACETA’s inaugural conference will be held in May 2018 www.aceta.org. au

This article first appeared in the print edition of CX Magazine December 2017, pp.62-63. CX Magazine is Australia and New Zealand’s only publication dedicated to entertainment technology news and issues. Read all editions for free or search our archive www.cxnetwork.com.au

Subscribe

Published monthly since 1991, our famous AV industry magazine is free for download or pay for print. Subscribers also receive CX News, our free weekly email with the latest industry news and jobs.